How to Protect Yourself from Credit Card Fraud?

As of June 2024, 47% of urban households in India reported at least one financial fraud over the past three years. 43% of those incidents involved credit cards. In a recent case, a 48-year-old professional from Hyderabad was duped of ₹1.8 Lakh when an individual pretending to represent a card issuer persuaded him to share sensitive details during a video interaction, exposing how easily trust can be manipulated

With rapid adoption of online payments, the scope for data breaches and unauthorised access has widened. Increasing reliance on electronic transactions demands greater awareness and vigilance to credit card fraud prevention and protect financial information.

What is Credit-Card Fraud?

Unauthorised transactions occur when confidential payment data is compromised and used for financial advantage. Offenders often manipulate stolen credentials to initiate withdrawals or complete online payments without the user’s awareness. Information such as card numbers, PINs and verification codes can be intercepted through discreet breaches or deceptive means.

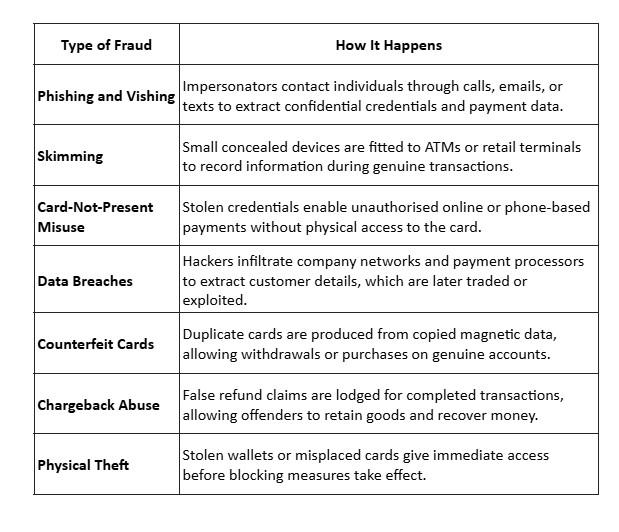

Kinds of Common Frauds

Financial deception takes many forms and often hides in everyday interactions. Each fraud technique occurs on a lapse in attention, which is why credit card fraud prevention must start with awareness.

Signs That Your Card/Identity May be Compromised

Irregular financial activity rarely begins loudly. It often surfaces through subtle inconsistencies that demand a careful eye.

-

Unfamiliar transactions: Review account movements closely. Even a small deduction can expose an attempt to verify stolen information before any bigger misuse occurs.

-

Unexpected OTPs or notifications: Receiving authentication codes or alerts without initiating any action indicates that sensitive details may already be circulating.

-

Unidentified merchants: Payments linked to vendors you have never engaged with can suggest interference or unauthorised data access.

-

Altered account details: Any revision to billing or contact information without consent hints at manipulation aimed at concealing further activity.

-

Interrupted statements or login errors: Missing updates or access issues may reveal tampering with account credentials or delivery preferences.

-

Falling credit score: A decline in rating often follows hidden liabilities, delayed settlements or loans obtained fraudulently under your name.

Credit Card Fraud Prevention Steps You Can Take

Vigilance is the first defence. As reported by the Reserve Bank of India, banks uncovered fraud worth ₹36,014 crore in FY 2024–25, underscoring the persistent scale of digital crime. Within today’s financial marketplace, maintaining control over your payment instruments depends on consistent caution and swift response.

-

Safeguard confidential data: Treat all credentials as private. Never reveal verification codes, PINs, or security digits via messages or calls. Genuine institutions never request such access through informal means.

-

Confirm source legitimacy: Impersonation remains a common tactic. Always cross-check any call or email through authorised channels before sharing any sensitive content.

-

Use protected connections: Avoid open Wi-Fi when accessing accounts or shopping online. A secure network — ideally with encryption — prevents interception of personal data.

-

Scrutinise unfamiliar communication: Fraudulent messages often imitate authentic branding or design. Watch for irregular spellings, domain inconsistencies, or unnatural requests before proceeding.

-

Stay cautious during physical payments: Ensure your card remains visible throughout a transaction. Report irregularities in payment machines or suspicious staff behaviour without hesitation.

-

Adopt encrypted payment modes: Wallet platforms that use tokenisation technology replace real account identifiers with coded alternatives, restricting merchants from storing your credentials.

-

Activate two-factor checks: Turn on 2FA to confirm every transaction through an OTP or secondary verification step.

-

Enable biometric verification: Cards and apps with fingerprint or facial recognition add a secure identity layer against misuse.

-

Control your expenditure range: Set transaction thresholds for contactless and online operations through your provider’s app. Adjust only when necessary to preserve flexibility and safety.

-

Dispose with care: Destroy outdated statements or expired cards before discarding them. Even discarded paperwork can be exploited if left intact.

What to Do if Fraud Happens?

Immediate response helps contain exposure and strengthens overall credit card fraud prevention.

-

Reach the bank directly. Request suspension of activity and prompt issue of a replacement to restore control.

-

File a formal claim for inaccurate deductions and preserve all correspondence for reference.

-

Register the incident with local authorities and request a fraud alert through a recognised credit bureau to curb further misuse.

Conclusion

In today’s fast-moving economy, real protection begins with awareness and the discipline to stay alert to changing risks. Risks may diversify, yet steady oversight keeps control intact. Each moment of attentiveness reinforces personal assurance and preserves integrity in digital exchange. When prudence becomes habit, stability endures even as systems evolve.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness